Get Ftb 3811 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb 3811 Form online

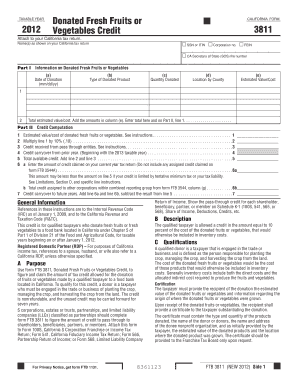

Filling out the Ftb 3811 Form online is an important process for individuals and organizations wishing to claim the Donated Fresh Fruits or Vegetables Credit in California. This guide provides clear, step-by-step instructions to help you navigate the form with ease.

Follow the steps to complete the Ftb 3811 Form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, provide the required information on the donated fresh fruits or vegetables. Fill in the date of donation, type of product, quantity donated, county location, and estimated value or cost for each donation. If necessary, use additional forms to include all donations.

- Move to Part II, Credit Computation. Start by entering the estimated value or cost of the donated products on Line 1, ensuring that this amount aligns with your inventory costs.

- On Line 2, multiply the amount from Line 1 by 10% to calculate the credit amount.

- Line 3 requires you to enter any credit received from pass-through entities, if applicable.

- Enter any credit carryover amount from the previous year on Line 4, applicable starting from the 2013 taxable year.

- Add the amounts from Lines 2 and 3 on Line 5 to determine the total available credit.

- On Line 6a, enter the amount of credit you are claiming on your current tax return, noting that it may be less than the total credit calculated due to limitations.

- If applicable, enter the total credit assigned to other corporations from Form FTB 3544 on Line 6b.

- Finally, calculate the credit carryover to future years on Line 7 by adding Lines 6a and 6b, then subtracting from Line 5. Save your changes and choose to download, print, or share your completed form.

Complete your Ftb 3811 Form online today to efficiently claim your tax credit.

If you are looking to set up an installment agreement with the Franchise Tax Board, the phone number you need is available on their official website. When discussing your options, be prepared to mention any forms you have filed, including the FTB 3811 Form. The representatives can guide you through the process and help you understand your payment options. Additionally, uslegalforms offers resources that can assist you in managing your tax obligations effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.