Get California Form 100x 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the California Form 100x 2012 online

Filling out the California Form 100x 2012 online can be straightforward with the right guidance. This comprehensive guide will walk you through each step of the process, ensuring that you complete the form accurately and efficiently.

Follow the steps to successfully complete your form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

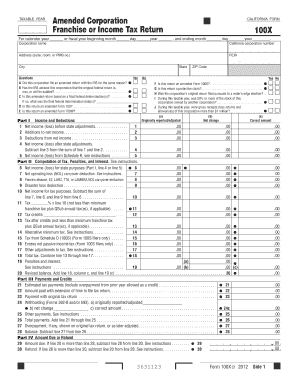

- Enter the taxable year in the designated field, specifying either the calendar year or providing the fiscal year’s starting and ending months and dates.

- Fill in the corporation name, California corporation number, and address, including suite, room, or PMB number and ZIP code.

- Provide the Federal Employer Identification Number (FEIN) in the appropriate field.

- Answer the questions presented in the form, selecting 'Yes' or 'No' for each relevant item regarding past amendments and federal determinations.

- In Part I, input your net income or loss before state adjustments, and complete the required additions and deductions as per the instructions provided.

- Calculate your net income or loss after state adjustments and refer to Schedule R as applicable.

- In Part II, compute the tax, penalties, and interest based on your net income for state purposes, ensuring you include all necessary adjustments.

- Proceed to Part III to list estimated tax payments, amounts paid with an extension, and total payments.

- In Part IV, determine the amount due or refund based on the calculations of your total payments and revised balance.

- In Part V, provide an explanation of changes made from the original return, detailing the line numbers and reasons for each adjustment.

- Sign and date the form where indicated, ensuring all required signatures are completed, including that of the preparer if applicable.

- Finally, review all entries for accuracy, then save changes, download, print, or share the completed form as necessary.

Begin the process of completing your California Form 100x 2012 online today!

If you are single, your decision to claim 0 or 1 allowances should reflect your financial goals and tax situation. Claiming 0 may be beneficial if you prefer a larger tax refund, while claiming 1 could provide more immediate income in your paycheck. Consider your total income, potential deductions, and whether you expect to owe taxes when filing. If you need further assistance in navigating these choices, US Legal Forms offers valuable resources tailored to your needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.