Loading

Get Tax Clearance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Clearance online

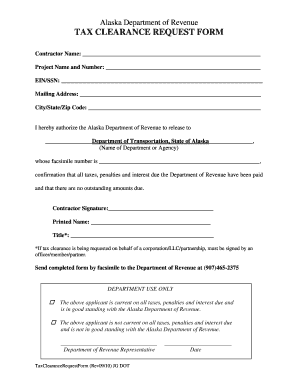

This guide will assist you in completing the Tax Clearance request form efficiently and accurately. By following these steps, you will ensure that all necessary information is provided to facilitate the approval process.

Follow the steps to successfully complete your Tax Clearance request.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering the contractor name in the designated field. Ensure that the name is spelled correctly as it appears on official documents.

- Next, fill in the project name and number. This helps to identify the specific project related to the tax clearance request.

- In the EIN/SSN section, provide the Employer Identification Number or Social Security Number associated with the contractor.

- Complete the mailing address section, including street address, city, state, and zip code for correspondence purposes.

- Authorize the release of information by filling in the name of the department or agency. This should include the full name of the Department of Transportation, State of Alaska.

- Record the facsimile number of the department or agency to which confirmation should be sent.

- Sign the form where indicated to authorize your request. This signature should be provided by the contractor or an authorized representative.

- Print your name and title in the respective fields. If you are signing on behalf of a corporation, LLC, or partnership, ensure you use the appropriate title.

- Once all fields are completed, review the form for any errors or omissions. Make necessary corrections before finalizing.

- Save your changes, and then download or print the completed form for your records.

- Finally, send the completed form by facsimile to the Department of Revenue at the specified number.

Complete your Tax Clearance request online today to ensure timely processing.

No, the IRS does not issue a tax clearance certificate. Instead, they provide a tax transcript or a letter confirming your tax status. If you need proof of compliance for other purposes, you can use these documents alongside your state tax clearance, which may be obtained through your local tax agency.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.