Get Subt-rp (10-05) - Alabama Department Of Revenue - Ador State Al

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SUBT-RP (10-05) - Alabama Department Of Revenue - Ador State Al online

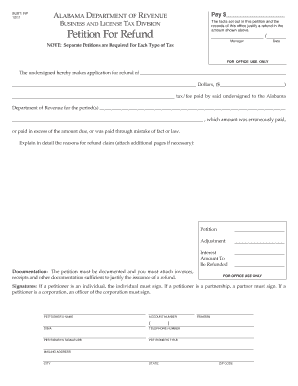

Filling out the SUBT-RP (10-05) form for refund claims with the Alabama Department of Revenue can seem daunting. This guide will provide you with clear, step-by-step instructions to ensure that you successfully complete the form online.

Follow the steps to expertly complete your refund petition.

- Click ‘Get Form’ button to access the SUBT-RP (10-05) form and open it in your preferred document editor.

- Begin by entering the amount you are requesting as a refund in the designated field labeled 'Pay $__________________'.

- In the next section, provide detailed explanations regarding the reasons for the refund claim. Make sure to specify the tax/fee paid and the relevant periods.

- Attach any necessary documentation, such as invoices and receipts, to support your refund request. Ensure that these are sufficient to justify the issuance of a refund.

- Complete the petitioner’s information fields, which include your name, account number, FEIN/SSN, and business name (D/B/A). Provide a valid telephone number and complete mailing address.

- If the petitioner is an individual, they must sign the form. For partnerships, a partner must sign, and for corporations, an authorized officer must provide their signature.

- Once all necessary fields are completed and all documentation is attached, review your petition for accuracy and completeness.

- Save your changes, then you can choose to download, print, or share the completed form according to your needs.

Submit your refund petition online today and ensure all your requests are processed efficiently.

Receiving a letter from the Alabama Department of Revenue and Income Tax Administration can be concerning, but it often serves a purpose. Such letters may inform you about discrepancies in your tax return, updates on your tax status, or important deadlines you need to meet. It is crucial to review the letter carefully and take necessary actions, as it could relate to your obligations under SUBT-RP (10-05) - Alabama Department Of Revenue - Ador State Al. If you need assistance, consider using US Legal Forms to navigate your response.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.