Loading

Get Form Nol 85

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Nol 85 online

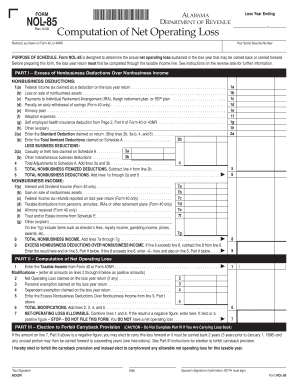

Filling out Form Nol 85 online is essential for individuals seeking to determine their net operating loss for the applicable loss year. This guide will walk you through each step of completing the form accurately and efficiently.

Follow the steps to complete Form Nol 85 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the header section with your name as shown on Form 40 or 40NR and your Social Security number. Also, input the date at the end of the loss year in the upper right corner.

- Proceed to Part I, where you will calculate the excess of nonbusiness deductions over nonbusiness income. Complete lines 1a through 9 as appropriate based on your deductions and income.

- In Part II, enter your taxable income from Form 40 or Form 40NR on line 1 and calculate modifications according to the instructions. Complete lines 2 through 6 accordingly.

- Sum up the modifications on line 6 and combine it with the taxable income on line 1 for the net operating loss allowable on line 7. Be sure to follow the provided examples for clarity.

- If applicable, complete Part III for the election to forfeit the carryback provision before signing the form.

- Finally, review all entries for accuracy, save your changes, download the completed form, and print or share it as needed.

Start filling out your documents online today for a seamless experience.

NOL works on a tax return by allowing taxpayers to offset taxable income with prior year losses. When you report a NOL using Form NOL 85, you can decrease the amount of income subject to taxation in future years. This mechanism is especially useful for businesses and individuals experiencing fluctuating incomes. Understanding this process can lead to better tax planning and savings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.