Get Questionnaire Revenue Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Questionnaire Revenue Form online

Filling out the Questionnaire Revenue Form online can be straightforward when you follow the proper steps. This guide will walk you through each section and field of the form, ensuring you have a clear understanding of the information required.

Follow the steps to successfully complete the Questionnaire Revenue Form

- Press the ‘Get Form’ button to access the form and open it in your online editor.

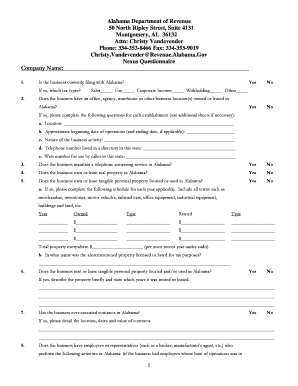

- Begin by entering the company name in the designated field. This information is crucial for identifying the business associated with the questionnaire.

- Indicate whether the business is currently filing with Alabama by selecting ‘Yes’ or ‘No’. If applicable, specify the tax types being filed.

- Answer questions regarding the location of business establishments in Alabama. Provide details such as the location address, operational dates, nature of activities, and relevant telephone numbers.

- Respond to queries about telephone answering services, ownership or leasing of real property, and tangible personal property used in Alabama. For each applicable year, fill in the required details.

- If the business rents or leases any property in Alabama, provide a brief description and the applicable years.

- Detail any executed contracts in Alabama, focusing on location, dates, and value.

- For each relevant activity performed in Alabama by employees or representatives, respond with ‘Yes’ or ‘No’. If ‘Yes’, provide detailed descriptions as requested.

- Continue answering questions regarding other activities such as advertising, local events, and services provided in Alabama.

- At the end of the questionnaire, ensure all fields are completed and verify that the information provided is accurate.

- You can now save changes, download, print, or share the completed form as needed.

Complete your Questionnaire Revenue Form online today for a smooth submission process.

To properly fill out a tax withholding form, start by reviewing your personal financial situation and estimating your tax liability. Fill in the required sections, including your filing status and the number of allowances you wish to claim on your Questionnaire Revenue Form. Always double-check your information for accuracy to prevent issues with tax withholding. For added support, uslegalforms provides resources to help you navigate this process smoothly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.