Loading

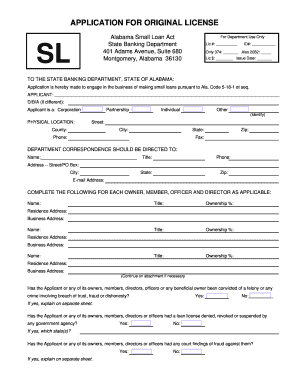

Get Small Loan Act Original Application - Banking Department

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Small Loan Act Original Application - Banking Department online

Filling out the Small Loan Act Original Application online can be a straightforward process if you know what to expect. This guide provides clear, step-by-step instructions to help you navigate each section of the application efficiently.

Follow the steps to complete the Small Loan Act Original Application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your applicant information. Fill in your name, and if applicable, the doing business as (D/B/A) name. Indicate the type of applicant such as corporation, partnership, individual, or other.

- Enter the physical location details, including street address, county, city, state, zip, phone, and fax numbers.

- Provide the contact information for department correspondence. This should include the name, title, phone number, state, zip, and mailing address of the designated contact person.

- For each owner, member, officer, and director, list their names, titles, and ownership percentages. Fill in their residence and business addresses as needed, and continue on an attachment if necessary.

- Answer the questions regarding any felony convictions or past loan license issues. Provide a separate explanation sheet if applicable.

- State whether other businesses will be conducted at the same location and describe any such business if applicable.

- Indicate if the applicant operates other locations in Alabama or other states. If yes, provide the trade name, state, and date originally licensed; continue on an attachment if necessary.

- Prepare and attach the required documentation, including the education and experience summary of each owner, certified copies of articles of incorporation, the most recent financial statement, letters of recommendation, TILA disclosure, and executed release forms.

- Include the payment details for the investigation fee and annual license fee, ensuring they are in the form of certified checks made payable to the State Banking Department.

- Complete the affidavit section by signing and dating it, ensuring it is sworn before a notary public.

- Once all fields are filled and attachments are included, you can save changes, download, print, or share the completed application.

Start filling out your Small Loan Act Original Application online today!

In a short application letter for a loan, clearly state your purpose and include your personal details. Briefly explain your financial needs and refer to the Small Loan Act Original Application - Banking Department to highlight your understanding of the requirements. Keep the letter concise while ensuring that all necessary information is included.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.