Get Illinois Ptax330 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Illinois Ptax330 Form online

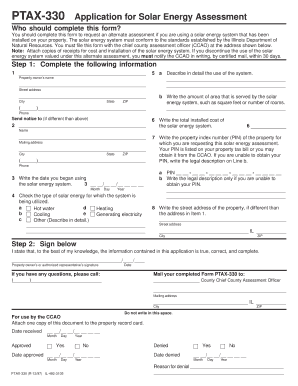

The Illinois Ptax330 Form is used to apply for an alternate assessment for properties that incorporate a solar energy system. This guide will walk you through the online process of completing this form with clarity and precision, ensuring you provide all necessary information for your application.

Follow the steps to successfully complete your Illinois Ptax330 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the property owner's name in the first field. This is essential to identify the owner of the solar energy system.

- Next, provide the street address, city, state, and ZIP code for the property. Ensure that this information is accurate to avoid any issues in processing your application.

- Indicate the amount of area served by the solar energy system. You may specify this in square feet or by the number of rooms served by the system.

- Enter a contact phone number for the property owner. This will be used for any follow-up communication regarding the form.

- If the notification should go to a different person, enter their name, address, city, state, ZIP code, and phone number in the next section.

- Record the total cost of installation for the solar energy system. This amount is crucial for determining the assessment value.

- Include the property index number (PIN) for the property or provide a legal description if you are unable to obtain the PIN.

- Input the date when the solar energy system was first used, following the format of month, day, and year.

- Select the type of solar energy system by checking the appropriate box. Options include heating, hot water, cooling, generating electricity, or other.

- If the address for the property differs from the information given earlier, write the street address, city, and ZIP code in this section.

- Sign the form to certify that all information provided is accurate. Include the date of signing.

- After completing all fields, review the information for accuracy, then choose to save your changes, download a copy, print the form, or share it as required.

Complete your Illinois Ptax330 Form online today to simplify your solar energy assessment application.

To apply for the homestead exemption in Illinois, you need to complete the Illinois Ptax330 Form, which is available online or at your local assessor's office. Ensure that you provide all required information, including proof of residency. Submit your completed form by the appropriate deadline for your county, typically early March. Once approved, the exemption will lower your property tax bill, providing financial relief.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.