Get Application For Property Tax Exempt Status - Minnehaha County ... - Minnehahacounty

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Property Tax Exempt Status - Minnehaha County online

Filling out the Application for Property Tax Exempt Status can feel overwhelming, but with the right guidance, you can navigate the process smoothly. This guide provides clear, step-by-step instructions to help you complete the application accurately and submit it online.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to access the application form and open it in your preferred editor.

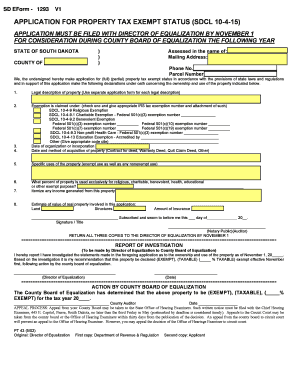

- Fill in the assessed name of the property owner along with the mailing address and phone number. Ensure to provide accurate contact information for any follow-up.

- Enter the parcel number assigned to the property. This number is crucial for identifying the property being claimed for tax exemption.

- Check whether you are applying for full or partial property tax exempt status and include any necessary supporting declarations.

- Provide the legal description of the property. If the property has more than one legal description, you will need to complete separate applications for each.

- Select the exemption category you are applying under from the provided options and include any relevant IRS exemption numbers.

- Document the date of organization or incorporation and the details regarding how the property was acquired.

- Describe the specific uses of the property, noting any exemptions and non-exempt uses clearly.

- Indicate the percentage of the property used solely for exempt purposes and detail any income generated from the property.

- Estimate the value of the real property involved by providing values for land and structures.

- Sign and date the application in the designated area, ensuring that it is notarized if necessary.

- Save your changes, download the completed form, and print it for mailing to the Director of Equalization by the deadline.

Take the first step towards obtaining property tax exempt status by filling out the application online today.

Yes, South Dakota sales tax exemption certificates can expire, depending on the circumstances. Typically, these certificates remain valid until the buyer's status changes or the seller revokes them. To ensure you are compliant and understand your rights, consider using the Application For Property Tax Exempt Status - Minnehaha County ... - Minnehahacounty to keep your records updated and informed.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.