Get Taxpayer Petition To The County Board Of Equalization For Review Of Personal Property Valuation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Taxpayer Petition To The County Board Of Equalization For Review Of Personal Property Valuation online

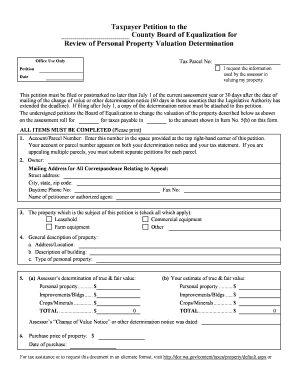

Filing a petition to the County Board of Equalization for a review of personal property valuation is an important step in ensuring that your property is assessed fairly. This guide will help you complete the Taxpayer Petition form online, providing clear instructions on each section of the document.

Follow the steps to fill out your Taxpayer Petition easily and accurately.

- Click the ‘Get Form’ button to obtain the Taxpayer Petition form and open it in your online editor.

- Enter the tax parcel number in the designated space at the top right corner of the petition. This number can be found on your determination notice and tax statement.

- Fill in the owner's name and the mailing address for all correspondence related to the appeal, including the street address, city, state, zip code, daytime phone number, and fax number.

- Indicate whether you are the property owner or an authorized agent by entering the relevant details in the form.

- Select all applicable options under the section describing the property which is the subject of the petition. Options include leasehold, commercial equipment, farm equipment, and other.

- Provide a general description of the property, including the address/location, description of any buildings, and type of personal property.

- In Item 5, enter both the assessor's determination of true and fair value and your estimate of true and fair value for personal property, improvements, and crops/minerals.

- Record the date and details of the assessor’s Change of Value Notice or other determination notice.

- Include the purchase price of the property and the date of purchase in the respective fields.

- Indicate whether the property has been remodeled or improved since purchase by selecting 'Yes' or 'No' and providing the cost if applicable.

- If applicable, indicate whether the property has been appraised by someone other than the County Assessor and provide the appraisal date, appraised value, and purpose of the appraisal.

- List the most recent sales of comparable properties within the past five years, including descriptions and sales prices.

- If the petition concerns income property, attach a statement of income and expense for the past two years, along with any leases or rental agreements.

- Provide specific reasons as to why the assessed valuation does not reflect the true and fair market value, and attach any supporting documentation.

- Check one of the statements that applies regarding additional documentary evidence to be submitted.

- Certify the petition by signing and dating the form, confirming that the information is true to the best of your knowledge.

Complete your Taxpayer Petition online today to ensure your property is valued accurately.

1:24 3:18 How To Cut Paper Straight With Scissors-Easy Tutorial - YouTube YouTube Start of suggested clip End of suggested clip So as you can see that is a perfectly straight line. And then the fourth. Step is if it requires.MoreSo as you can see that is a perfectly straight line. And then the fourth. Step is if it requires. More than one cut you want to line up your scissors with the current cut that you have okay and then.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.