Get 2013 Confidential Personal Property Return Oregon Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Confidential Personal Property Return Oregon Form online

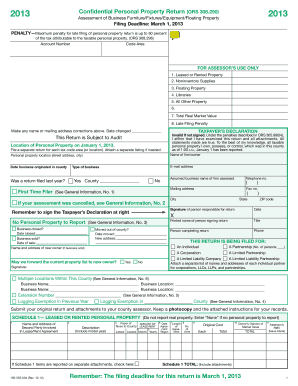

Filling out the 2013 Confidential Personal Property Return form correctly is essential for the accurate assessment of your taxable personal property in Oregon. This guide provides a step-by-step approach to help users navigate the form easily and efficiently, ensuring all necessary information is included.

Follow the steps to complete your form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your account number at the top of the form. This is essential for identifying your tax account.

- Next, indicate whether you have any leased or rented property, and fill in the relevant details in the corresponding section.

- Proceed to report any noninventory supplies that you hold as of January 1. List the total cost on hand for any taxable items.

- If applicable, provide information regarding any floating property, including registration numbers and purchase details.

- Fill out the professional libraries section if you possess any, reporting the type and number of volumes, along with their costs and estimated market values.

- Complete the schedule of all other taxable personal property not reported elsewhere in the form, including a description, cost, and estimated market value.

- Ensure to fill out the taxpayer’s declaration section at the end of the form, confirming the accuracy of your reported information.

- Once all fields are filled, save your form and prepare to submit it. Ensure all attachments are ready if required.

- At finalization, download, print, or share the completed form as needed, keeping a copy for your records.

Complete your 2013 Confidential Personal Property Return online today to avoid penalties and ensure compliance.

In Oregon, there is no specific age at which property taxes cease, but seniors may qualify for certain exemptions or deferrals. These programs can significantly reduce the burden of property taxes for eligible individuals. Understanding how to navigate these options is important, especially when filing the 2013 Confidential Personal Property Return Oregon Form. For further assistance, uslegalforms can help clarify available options for property tax relief.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.