Get Application For Deduction From Assessed Valuation Of Structures...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Deduction From Assessed Valuation Of Structures online

This guide provides comprehensive instructions on how to successfully complete the Application For Deduction From Assessed Valuation Of Structures online. By following these steps, users can confidently navigate the form and ensure their submissions are accurate and timely.

Follow the steps to complete your application efficiently.

- Click ‘Get Form’ button to access the Application For Deduction From Assessed Valuation Of Structures. This will allow you to open the form in your preferred digital environment.

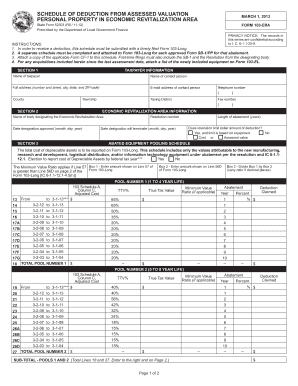

- Begin by providing your taxpayer information in Section 1. Include the name of the taxpayer, name of the contact person, full address, email address, and telephone number. Ensure each field is completed accurately to prevent processing delays.

- In Section 2, you will need to enter details about the Economic Revitalization Area. This includes the name of the designating body, approval date of the designation, resolution number, and the length of the abatement. Additionally, indicate if there is a limit on the dollar amount of deduction.

- Proceed to Section 3, where you will report the abated equipment pooling schedule. You must enter the total cost of depreciable assets as required. Follow the prompts for each box, entering the values from the corresponding lines of Form 103-Long.

- Complete any necessary calculations regarding the minimum value ratios and total deductions across all pools. Ensure that any special tooling details are included if applicable.

- Once all sections are completed, review the entered information for accuracy. You may choose to save your changes, download the completed form, print it for physical submission, or share it electronically as needed.

Take the next step in your application process by filling out the required forms online today.

Applying for tax-exempt status in Missouri involves filling out the appropriate application forms, including the Application For Deduction From Assessed Valuation Of Structures. You will need to provide documentation that supports your claim, such as proof of income or disability. Reaching out to your local tax authority can provide additional guidance on the application process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.