Get 2006 Bpp Web Form1.pmd - Fairfax County Government - Fairfaxcounty

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2006 BPP Web Form1.pmd - Fairfax County Government - Fairfaxcounty online

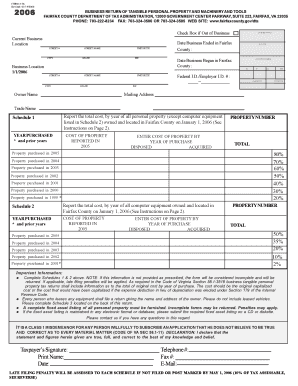

This guide provides clear instructions for accurately filling out the 2006 Business Return of Tangible Personal Property and Machinery and Tools form for Fairfax County. Following these steps will ensure that your submission is complete and reduces the risk of penalties for late filing.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in your document management system.

- Check the box indicating if your business is out of operation. If not, proceed to enter your current business location, including the street number, street name, city, state, and ZIP code.

- Fill in the date when your business began and ended in Fairfax County, along with the appropriate account number and SIC code.

- Provide the owner's name and their federal ID/employer ID number. Ensure all information is accurate to avoid issues.

- Complete Schedule 1 by reporting the total cost of all tangible personal property owned in Fairfax County on January 1, 2006. Include property acquired and disposed of during that year.

- In Schedule 2, report the total cost of all computer equipment owned in Fairfax County. Again, include costs by year of purchase and make sure to note any disposals.

- If applicable, fill out Schedule 3 for any leased properties. Include the name and address of the owners, type of equipment, lease dates, and purchase prices.

- Review all sections for accuracy. Do not alter preprinted amounts. Make changes to only the columns specified: 'Disposed' or 'Acquired.'

- Finalize the form by signing it, including your printed name, date, and contact information. Ensure to double-check everything before submission.

- Once complete, save any changes made to the form. You may then download, print, or share your completed form as needed.

Complete your documents online to ensure timely filing and avoid any penalties.

To appeal your property tax assessment in Fairfax County, you must first review your assessment notice and gather relevant documentation. Next, you can file an appeal with the Board of Equalization, providing evidence to support your claim. It is essential to meet deadlines and follow procedures outlined by the Fairfax County Government. For assistance and access to necessary forms, including the 2006 BPP Web Form1.pmd - Fairfax County Government - Fairfaxcounty, consider using platforms like uslegalforms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.