Loading

Get Ftb 8454

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb 8454 online

Navigating tax forms can be challenging, but with the correct guidance, filling out the Ftb 8454 can be straightforward. This guide provides step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the Ftb 8454 online.

- Click the ‘Get Form’ button to access the electronic version of the Ftb 8454, allowing you to fill it out online.

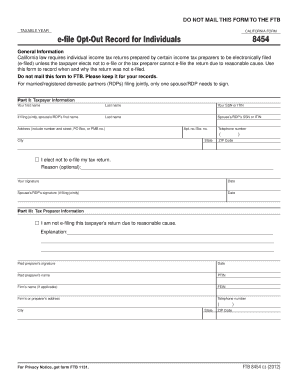

- In Part I, provide your personal information, including your first name, last name, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If you are filing jointly, also include your spouse’s or registered domestic partner’s first name, last name, and SSN or ITIN.

- Next, fill in your address, which should include the street address, apartment number or suite number, city, state, and ZIP code. Ensure all information is correct to avoid processing issues.

- Indicate your preference about e-filing by selecting the checkbox stating ‘I elect not to e-file my tax return.’ You may also provide a reason for this choice, although this part is optional.

- Sign and date the form in the designated areas. If you are filing jointly, your spouse or registered domestic partner will also need to sign and date the form.

- Move to Part II to provide information about your tax preparer. Here, indicate the reason for not e-filing, if applicable, and offer a detailed explanation. Include the paid preparer’s signature, name, PTIN, and any relevant firm information.

- Complete the firm’s address and telephone number, including city, state, and ZIP code.

- Once you have entered all necessary information, ensure to save your changes. You may also choose to download, print, or share the completed Ftb 8454 form as needed.

Start filling out your Ftb 8454 online today to streamline your tax process.

Related links form

Demand to File Penalty If we send you a demand to file your income tax return or to provide us with information, and you do not comply, we impose a penalty of 25 percent of the tax on our assessment before applying any payments or credits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.