Loading

Get Ir162 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ir162 Form online

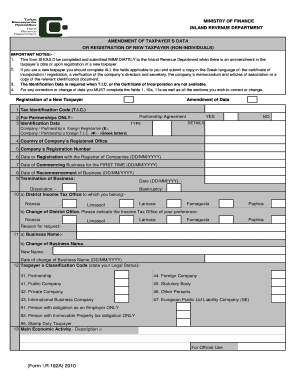

The Ir162 Form is essential for individuals and businesses who need to amend taxpayer data or register as new taxpayers. This guide provides step-by-step instructions on completing the form online, ensuring all necessary information is provided accurately.

Follow the steps to complete the Ir162 Form easily online.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin with the 'Tax Identification Code (T.I.C.)' section. If you are registering as a new taxpayer, ensure all applicable fields are completed accurately.

- For partnerships, fill in the partnership agreement details. Select 'Yes' or 'No' to indicate if you are a partnership.

- Complete the 'Identification Data' section as necessary, particularly if the T.I.C. or Certificate of Incorporation is unavailable.

- Provide the 'Country of Company’s Registered Office' and 'Company’s Registration Number'.

- Enter the 'Date of Registration with the Registrar of Companies' and the 'Date of Commencing Business for the First Time'.

- Specify any changes regarding 'Termination of Business' and choose the appropriate 'District Income Tax Office'.

- Fill out the business name fields, including any changes and the date of the change.

- Indicate the 'Taxpayer’s Classification Code' based on your legal status.

- Describe the 'Main Economic Activity' clearly to reflect your business operations.

- Provide details of any representatives, auditors, or firms associated with your business.

- Complete the 'Communication Language' and 'Business Address' sections accurately.

- Finally, review all completed fields for accuracy, then save your changes, download, print, or share the form as needed.

Complete your paperwork today by filling out the Ir162 Form online.

Yes, form 8962 can be filed electronically when you submit your tax return through an IRS-approved software. This method streamlines the process and minimizes the chances of errors. Ensure that you have all the necessary information related to the Ir162 Form ready for a smooth filing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.