Loading

Get Ca Form 3885a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ca Form 3885a online

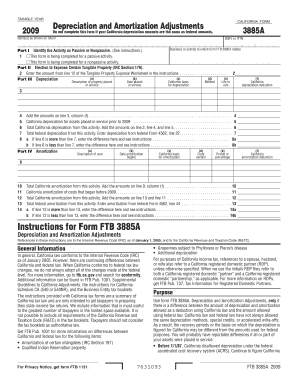

Filling out the Ca Form 3885a, Depreciation and Amortization Adjustments, is essential for reporting differences between California and federal depreciation methods. This guide provides clear, step-by-step instructions to assist you in completing the form online efficiently.

Follow the steps to fill out the Ca Form 3885a online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your name(s) as shown on your return at the top of the form.

- Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the designated field.

- Identify the business or activity related to the form by providing the relevant details.

- Part I requires you to check a box to indicate whether the activity is passive or nonpassive.

- In Part II, enter the amount from line 12 of the Tangible Property Expense Worksheet as applicable.

- Part III requires you to describe the property placed in service and provide details such as date placed in service, California basis for depreciation, method, and life or rate for each asset.

- Complete the calculation for total California depreciation. Add the amounts from the provided lines in Part III.

- Proceed to Part IV to detail your amortization. Fill out the description of costs, the date amortization begins, and other necessary fields.

- Complete your calculations for total California amortization and check for any differences with federal amounts.

- Once all sections are completed, save your changes, and download, print, or share the form as needed.

Ensure you complete your Ca Form 3885a online to accurately report your depreciation and amortization adjustments.

To obtain a copy of your 1095 A from Covered California, log into your Covered California account and navigate to your tax documents section. You can also request a copy through customer service if you have trouble accessing your account. Keeping your 1095 A handy is essential for correctly filing your taxes, including the CA Form 3885A.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.