Get Form 3587

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3587 online

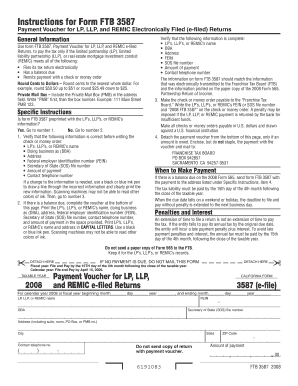

Filling out the Form 3587 online is a straightforward process that helps limited partnerships, limited liability partnerships, and real estate mortgage investment conduits fulfill their tax payment obligations. This guide provides clear instructions to ensure you complete the form correctly and efficiently.

Follow the steps to successfully complete the Form 3587 online

- Click the ‘Get Form’ button to obtain the Form 3587 and open it in your preferred online editor.

- Review the preprinted information on the form. If the LP’s, LLP’s, or REMIC’s details such as name, address, and federal employer identification number are correct, go to step 3. If corrections are needed, use a black or blue ink pen to cross out the incorrect information and clearly print the new details.

- If there is a balance due, ensure you complete the payment voucher section at the bottom of the form. Input the necessary information including the name, DBA, address, FEIN, SOS file number, contact telephone number, and the amount of payment, making sure to use capital letters as indicated.

- Check to confirm that all information is accurate and complete. It should match with the information sent electronically to the Franchise Tax Board and printed on the 2008 Form 565.

- Prepare your payment by making the check or money order payable to the ‘Franchise Tax Board.’ Clearly write the FEIN or SOS file number and note ‘2008 FTB 3587’ on the payment instrument.

- Detach the payment voucher from the bottom of the form only if an amount is owed. Enclose the payment with the voucher (do not staple) and send it to the address specified.

- Save your changes, then download, print, or share the form as necessary to keep a record of your submission.

Complete your Form 3587 online today to ensure timely tax payment and prevent any late fees.

CA Form 3588 is a document related to California's tax regulations, specifically designed for reporting certain financial activities. This form is essential for individuals and businesses to maintain transparency and compliance with state laws. Understanding the requirements of Form 3588 can help you avoid complications with the state. For a seamless experience in managing your tax forms, consider using the US Legal Forms platform, which offers comprehensive resources and support.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.