Loading

Get Ftb Form 3522

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb Form 3522 online

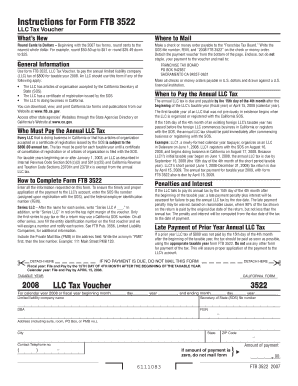

Filling out the Ftb Form 3522, also known as the LLC Tax Voucher, is an essential step for limited liability companies operating in California. This guide offers clear, step-by-step instructions on how to complete the form online to ensure accurate payment of the annual LLC tax.

Follow the steps to complete the Ftb Form 3522 online.

- Press the ‘Get Form’ button to access the Ftb Form 3522 and open it in your preferred online editor.

- Carefully enter the taxable year for which you are filing in the designated field. If applicable, input the start and end dates of your fiscal year.

- If your LLC operates under a doing business as (DBA) name, be sure to include that as well. Additionally, enter the federal employer identification number (FEIN) in the appropriate field.

- Complete the address section, ensuring to include any suite, room, PO Box, or Private Mail Box (PMB) number. Use the acronym 'PMB' followed by the box number for clarity.

- Enter the contact telephone number for your LLC. This information may be required for any follow-up communications regarding your payment.

- Indicate the amount of payment you are submitting. Remember to round any cents to the nearest whole dollar.

- Review all entered information for accuracy. After ensuring everything is correct, you can save your changes, download the filled-out form, and print it for your records or submission.

- Once printed, detach the payment voucher, include your check or money order made payable to the 'Franchise Tax Board,' and mail it to the appropriate address provided on the voucher.

Complete and submit your Ftb Form 3522 online today to ensure compliance with California's LLC tax requirements.

The primary difference between Form 3536 and FTB Form 3522 lies in their purposes. Form 3536 is for estimated tax payments, whereas Form 3522 deals with the annual franchise tax owed by LLCs. Knowing which form to file at the right time is essential for financial planning. The USLegalForms platform can guide you through these requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.