Get Statement Of Income From Trust Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Statement Of Income From Trust Fillable Form online

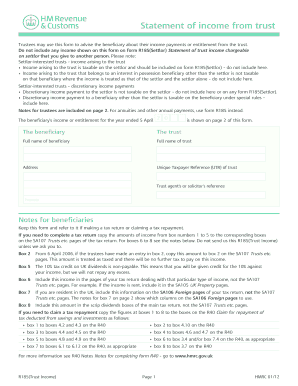

Filling out the Statement Of Income From Trust Fillable Form online is a straightforward process that allows trustees to communicate critical income information to beneficiaries. This guide will provide step-by-step assistance on how to complete the form accurately and efficiently.

Follow the steps to complete the Statement Of Income From Trust Fillable Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the beneficiary section, where you must enter the full name of the beneficiary and the full name of the trust. Additionally, provide the address, unique taxpayer reference (UTR) of the trust, and the trust agent’s or solicitor’s reference, including the postcode.

- Move to the income reporting sections, which are divided into boxes. Carefully input the income amounts for each relevant box. Be mindful to enter only the amounts that pertain to the specific income types outlined, such as discretionary payments and non-discretionary income.

- For discretionary income payments from settlor-interested trusts, fill in the amounts accordingly. Ensure to note if any tax credits have been deducted at the trust rate, and record these amounts in the appropriate boxes.

- Continue filling in the various income types, including non-savings income, foreign income, and stock scrip dividends. Ensure all taxable amounts, tax paid, and any tax credits are correctly reported.

- Review all the information you have entered to confirm its accuracy. Once satisfied, finalize the form by either saving changes, downloading, printing, or sharing the completed form as required.

Start completing your Statement Of Income From Trust Fillable Form online now to ensure accurate and timely reporting.

Yes, you can draw income from a trust, but the ability to do so depends on the trust's terms and conditions. Typically, a trustee manages the distribution of income to beneficiaries. By utilizing the Statement Of Income From Trust Fillable Form, you can easily track and document any distributions you receive. This form helps ensure that all income is accounted for and reported correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.