Loading

Get Form 27d

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 27d online

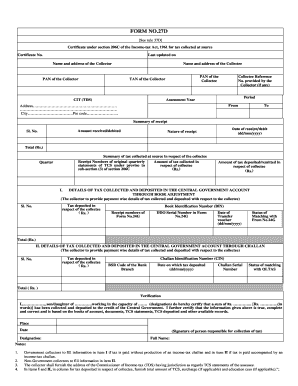

Form 27d is a critical document required for certifying tax collected at source under section 206C of the Income-tax Act, 1961. This guide will provide you with clear step-by-step instructions to ensure accurate and efficient completion of the form online.

Follow the steps to successfully complete Form 27d online.

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- Fill in the certificate number at the top of the form. This is a unique identifier for the specific certificate being generated.

- Include the last updated date for the form to reflect the current status.

- Provide the name and address of the collector, along with their PAN (Permanent Account Number). This identifies who is responsible for collecting the tax.

- Input the name and address of the collectee. Ensure to also provide their PAN for identification purposes.

- Enter the TAN (Tax Deduction and Collection Account Number) of the collector to facilitate processing.

- Provide the CIT (TDS) details which relate to the tax deducted at source.

- If applicable, fill in the collectee reference number provided by the collector.

- Specify the period for which the tax is collected along with the assessment year, indicating the financial year concerned.

- In the summary of receipt section, list the amount received or debited, including the sl. no., date of receipt, and nature of receipt.

- In the tax collected summary, insert the receipt numbers from original quarterly statements and the amount of tax collected relevant to the collectee.

- For tax deposited information, include the details in parts I and II as related to the central government accounts, detailing the payment-wise data.

- Confirm the details regarding the verification section by providing the certification statement, along with the name, title, and signature of the responsible person.

- Once the form is fully completed, you have options to save changes, download, print, or share the form as necessary.

Start filling out the necessary documents online today for a streamlined process.

Form 27D is typically issued by tax authorities or financial institutions involved in regulatory compliance. These organizations provide this form to ensure that taxpayers maintain accurate records and adhere to tax laws. It is important to understand the issuing authority to avoid potential issues. US Legal Forms can help you find the right templates and information related to the issuance of the Form 27D.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.