Get Dissolution Of A Fairfax County Va Business Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Dissolution Of A Fairfax County Va Business Form online

Dissolving a business is an important step that requires careful attention to detail. This guide will walk you through the process of completing the Dissolution Of A Fairfax County Va Business Form online, ensuring all necessary information is accurately provided to successfully dissolve your business.

Follow the steps to fill out the Dissolution Of A Fairfax County Va Business Form online.

- Click the ‘Get Form’ button to access the form and open it in your preferred editing tool.

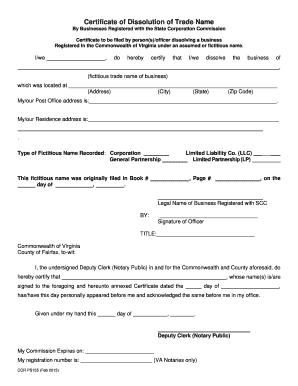

- In the first section, fill in your name or the names of the individuals dissolving the business.

- Next, indicate the fictitious trade name of your business in the provided space.

- Complete the address where your business was located, including the street address, city, state, and zip code.

- Then, provide your Post Office address, making sure it is accurate.

- Include your residence address to establish your connection to the business.

- Specify the type of fictitious name recorded, selecting from options like Corporation, General Partnership, Limited Liability Company (LLC), or Limited Partnership (LP).

- Record the page number where your fictitious name was originally filed, along with the date of that filing.

- Fill in the legal name of the business registered with the State Corporation Commission (SCC).

- After ensuring all information is correct, sign the form in the designated space, and print your title under the signature.

- Finally, submit the certificate to the Deputy Clerk or Notary Public for verification and acknowledgment.

- Upon completion, save the changes, download, print, or share the filled-out form as needed.

Take the next step and complete your forms online to ensure a smooth business dissolution process.

Dissolving a business in Virginia involves a few essential steps. Start by completing the Dissolution Of A Fairfax County Va Business Form, which you can find on the Virginia State Corporation Commission's website. After submitting this form, ensure you meet all financial responsibilities, such as paying taxes and closing accounts. By following these steps, you will successfully dissolve your business in Virginia.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.