Get Motor Vehicle Rental Tax Exemption Certificate - Texas Comptroller ... - Window State Tx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Motor Vehicle Rental Tax Exemption Certificate - Texas Comptroller online

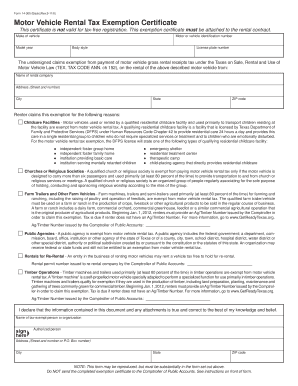

This guide provides comprehensive instructions on how to accurately complete the Motor Vehicle Rental Tax Exemption Certificate required by the Texas Comptroller. By following these steps, users can ensure they provide the necessary information correctly to obtain their tax exemption.

Follow the steps to complete the exemption certificate online.

- Click ‘Get Form’ button to obtain the Motor Vehicle Rental Tax Exemption Certificate and open it in your preferred editor.

- Enter the make of the vehicle in the designated field. This includes the manufacturer or brand name of the vehicle you are renting.

- Provide the motor or vehicle identification number (VIN), which uniquely identifies the vehicle. This number is crucial for processing your exemption.

- Fill in the model year of the vehicle being rented. This information helps to determine the vehicle's compliance with relevant rental regulations.

- Specify the body style of the vehicle, such as sedan, SUV, truck, etc., to give further identification of the vehicle type.

- Input the license plate number as shown on the vehicle. This number is another identifier that must be included.

- Identify the rental company by stating their name and complete address, including street number, city, state, and ZIP code.

- Select the applicable reason for claiming tax exemption by indicating one of the options provided, such as childcare facilities, churches, public agencies, or farm vehicles.

- If claiming exemption under certain categories (e.g., childcare facilities, agricultural purposes), be prepared to provide any required identification numbers, like an Ag/Timber Number, if applicable.

- Complete the declaration section by entering the name of the person or organization claiming the exemption and the address as prompted.

- Ensure that the form is signed by an authorized individual representing the tax-exempt organization, confirming the truthfulness of the information provided.

- Once you have filled out all sections of the form, save your changes. You can then download, print, or share the completed exemption certificate as necessary.

For additional forms and details, complete your documentation online today.

In Texas, rentals can be tax exempt under certain conditions, particularly if you possess a valid Motor Vehicle Rental Tax Exemption Certificate - Texas Comptroller ... - Window State Tx. This exemption primarily applies to specific organizations, including government entities and non-profits. To benefit from this exemption, you must ensure that the rental agency recognizes and accepts your certificate. Always check with the rental company to confirm their policies regarding tax exemptions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.