Get Ftb 4502 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb 4502 Form online

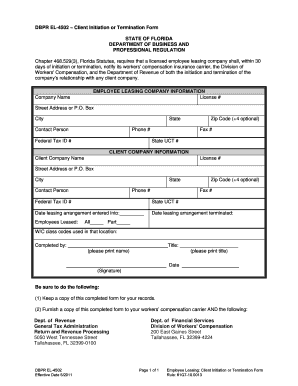

The Ftb 4502 Form is essential for notifying relevant parties about the initiation or termination of a client relationship by licensed employee leasing companies. This guide will provide you with step-by-step instructions to help you complete this form online effectively.

Follow the steps to fill out the Ftb 4502 Form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the employee leasing company information. This includes entering the company name, license number, street address or P.O. Box, city, state, contact person’s name, phone number, federal tax ID, ZIP code (plus optional four digits), fax number, and state UCT number.

- Next, provide the client company information. Fill in the client company name, license number, street address or P.O. Box, city, state, contact person’s name, phone number, federal tax ID, ZIP code (plus optional four digits), fax number, and state UCT number.

- Indicate the dates for the leasing arrangement by entering the date it was initiated and the date it was terminated.

- Specify the number of employees leased by selecting the appropriate option: ‘All’ or ‘Part’.

- Enter the workers’ compensation class codes used in the specified location.

- Complete the form by printing your title and name in the designated fields, then add your signature and the date.

- Finally, save your changes to the form. You can then choose to download, print, or share the completed Ftb 4502 Form as needed.

Take the next step and fill out your Ftb 4502 Form online today!

Generally, you do not need to attach a copy of your federal return to your California state return. However, if you are filing specific forms, such as the FTB 4502 Form, it may be beneficial to include relevant sections of your federal return for clarity and to support your claims. Always check the latest guidelines from the FTB to ensure compliance. Using US Legal Forms can simplify this process by providing you with the needed templates and instructions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.