Loading

Get Form Ps-1040r-na - Texas Workforce Commission - Twc State Tx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form PS-1040R-NA - Texas Workforce Commission - Twc State Tx online

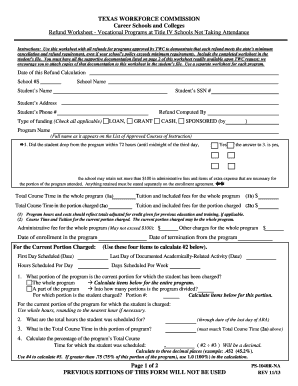

Filling out the Form PS-1040R-NA is an essential process for ensuring compliance with refund policies regarding vocational programs. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to download the form and open it for editing.

- Begin by entering the date of your refund calculation, the school number, and the school name at the top of the form. Ensure that you provide accurate information.

- Fill in the personal details of the student, including their name, Social Security Number, address, and phone number—this information is crucial for identification.

- Indicate who computed the refund by writing down their name or position.

- Check the types of funding applicable to the student (loan, grant, cash, sponsored), ensuring all relevant options are selected.

- Specify the program name as it appears on the List of Approved Courses of Instruction. This must be accurate to avoid any discrepancies.

- Answer the yes/no questions regarding the student's drop from the program, ensuring that the information accurately reflects the timing of the student's withdrawal.

- Provide details about the total course time and tuition fees for both the entire program and the portion charged, ensuring you follow the directions on how to handle previous education credit.

- Utilize the calculations outlined in the form to determine what portion of the program the refund applies to, including all necessary computations for hours scheduled and percentages.

- Review the total earned by the school for the whole program, based on the documented tuition and fees. Ensure all calculations are accurate.

- Finally, ensure the form is completed by detailing the refund due, balance due, and attaching supporting documentation as referenced in the instructions.

- Once all sections are filled out accurately, save your changes, download a copy for your records, and print or share the form as necessary.

Complete your forms online to ensure a smooth submission process.

Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.