Get Tac 81.201(a) Conditional Qualification Letter. Rmlo Forms - Sml Texas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TAC 81.201(a) Conditional Qualification Letter. RMLO Forms - Sml Texas online

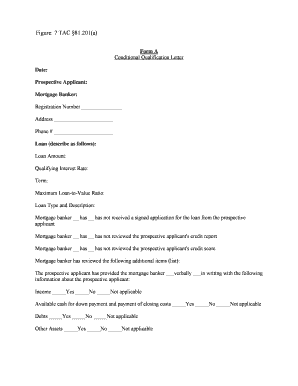

Completing the TAC 81.201(a) Conditional Qualification Letter is an essential step in the mortgage process. This guide provides clear and comprehensive instructions to help users fill out this form accurately and efficiently.

Follow the steps to successfully complete the Conditional Qualification Letter.

- Press the ‘Get Form’ button to access the TAC 81.201(a) Conditional Qualification Letter and open it for editing.

- Fill in the date at the top of the form. This should be the date on which you are submitting the document.

- Provide the name of the prospective applicant in the designated field. This is the individual or entity seeking the loan.

- Enter the name of the mortgage banker involved in the transaction, along with their registration number, which can be found on their registration documents.

- Complete the address line with the mortgage banker’s official address.

- Include the contact phone number for the mortgage banker.

- In the loan section, describe the loan, including the loan amount, qualifying interest rate, term, and maximum loan-to-value ratio.

- Specify the loan type and provide a brief description of the loan.

- Indicate whether the mortgage banker has received a signed application for the loan from the prospective applicant by checking either 'has' or 'has not'.

- Mark whether the mortgage banker has reviewed the prospective applicant's credit report and credit score, using the same method as the previous step.

- List any additional items the mortgage banker has reviewed about the prospective applicant, if applicable.

- Provide information on whether the prospective applicant has provided income, available cash for down payment, debts, and other assets either verbally or in writing. Mark each section with 'Yes', 'No', or 'Not applicable' as appropriate.

- Review the section that states the mortgage banker’s determination regarding the eligibility of the prospective applicant based on provided information.

- Ensure all conditions for loan approval are acknowledged, and list any additional items that may be required for loan approval.

- Sign the form as the mortgage banker or loan officer, completing the process.

- Once all fields are completed, you can save your changes, download the completed form, print it, or share it as necessary.

Take the next step in your mortgage journey by completing the TAC 81.201(a) Conditional Qualification Letter online.

Yes, it is possible to obtain a pre-approval letter without a hard pull on your credit. Some lenders offer a soft pull option that allows them to assess your creditworthiness without impacting your score. This can give you a good estimate of your eligibility while minimizing any potential damage to your credit. By using the TAC 81.201(a) Conditional Qualification Letter, you can also clarify your financial standing and expedite your pre-approval process, especially when leveraging RMLO Forms - Sml Texas.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.