Get Capital Commitment Letter

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Capital Commitment Letter online

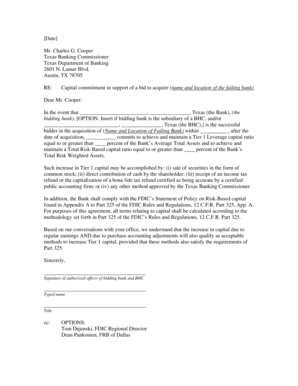

The Capital Commitment Letter is a crucial document for individuals or organizations bidding to acquire a failing bank. This guide provides you with clear, step-by-step instructions to ensure you complete the form accurately and efficiently online.

Follow the steps to complete the Capital Commitment Letter online.

- Press the ‘Get Form’ button to access the Capital Commitment Letter and open it for editing.

- Begin by entering the name and location of the failing bank in the designated placeholder. This should reflect the bank you are bidding to acquire.

- In the section outlining your commitment, specify the name of the bidding bank and, if applicable, the bank holding company (BHC).

- Fill in the timeframe for achieving the outlined Tier 1 Leverage and Total Risk-Based capital ratios. Indicate the specific percentage values for these ratios based on your financial capabilities.

- Detail the methods through which the required increase in Tier 1 capital will be accomplished, including options like the sale of securities, cash contributions, or other approved methods.

- Ensure that you include reference to the FDIC’s Statement of Policy on Risk-Based Capital in the form. This compliance assures relevance to regulatory standards.

- Lastly, include your signature as the authorized officer of the bidding bank and, if applicable, the BHC. Also, type your name and title in the respective fields.

- Once all fields are completed, you can save your changes, download the document, print it, or share it as needed.

Fill out your Capital Commitment Letter online today to ensure your bid is properly submitted.

A good commitment letter should be clear, concise, and professional. Start with a friendly greeting, then clearly articulate your commitment, specifying the capital amount and purpose. To enhance clarity, organize the information logically and maintain a respectful tone throughout. By utilizing resources like a Capital Commitment Letter template from USLegalForms, you can ensure your letter meets all requirements and effectively communicates your intentions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.