Loading

Get It 221 Instructions Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT 221 Instructions Form online

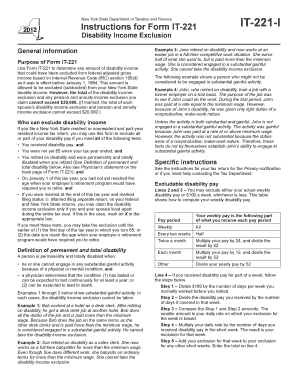

Filling out the IT 221 Instructions Form is a necessary step for individuals seeking to exclude specific disability income from their taxable income in New York State. This guide provides clear, step-by-step instructions to assist you in completing the form efficiently and accurately.

Follow the steps to fill out the IT 221 Instructions Form online.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- Review the general information provided in the form, including the eligibility criteria for excluding disability income. Ensure that you meet all the outlined tests to qualify.

- For lines 2 and 3, follow the provided table to calculate your weekly disability pay based on your pay period. Ensure you multiply your pay accordingly and divide by 52 if needed.

- If you received disability pay for part of a week, complete the calculations as described in Line 4. Follow each step to determine your daily rate and total exclusion for that week.

- Continue through the form, verifying your entries are complete and accurate, especially when it comes to limits on exclusions as outlined, ensuring you do not exceed the maximum allowable amount.

- Finally, save your changes, and choose to download, print, or share the IT 221 Instructions Form as needed, ensuring you include this form with your tax return.

Start completing your IT 221 Instructions Form online today!

Filling out an income tax return form can be straightforward if you follow the right steps. Start by gathering all necessary financial documents, such as W-2s and 1099s. The IT 221 Instructions Form offers a step-by-step guide that helps you understand each section of the form. By following these instructions carefully, you can complete your return accurately and efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.