Get Ifta 105

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ifta 105 online

Filling out the IFTA 105 form online is an essential step for individuals and organizations involved in interstate fuel tax reporting. This guide provides clear and detailed instructions to ensure a smooth and accurate submission process.

Follow the steps to complete your IFTA 105 form online.

- Press the 'Get Form' button to access the IFTA 105 form and open it in your preferred online editor.

- Provide the necessary personal or business information, including your name, address, and account number. Ensure the details match your tax identification.

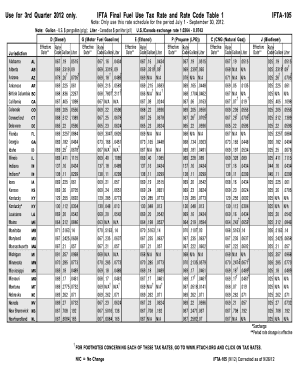

- Fill in the section for the reporting period by entering the specific dates for which you are reporting fuel use. For the third quarter of 2012, this should be from July 1 to September 30.

- Indicate the jurisdictions in which fuel was consumed by entering the corresponding codes from the rate table provided. This includes specifying the type of fuel used, such as diesel or gasoline.

- Input the gallons or liters of each fuel type consumed in the respective jurisdictions as outlined in the form.

- Review all entries for accuracy, making sure that all required fields are completed correctly.

- Once all information is verified, you can save the document, download it for your records, or print it directly from the online platform.

Complete your IFTA 105 form online today to stay compliant with interstate fuel tax regulations.

An IFTA audit can be triggered by various elements, such as inconsistent reporting of fuel data, frequent late filings, or significant changes in your fuel tax returns. If your fuel consumption patterns do not align with your reported mileage, this can also lead to an audit. To minimize your risk, it's crucial to maintain thorough and accurate records. Using US Legal Forms can streamline this process and help ensure compliance with IFTA requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.