Loading

Get Form It 203 Att

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-203 Att online

Filling out the Form IT-203 Att online can be a streamlined process when you know how to navigate each section effectively. This guide will provide you with clear, step-by-step instructions to ensure your form is completed accurately and efficiently.

Follow the steps to complete your Form IT-203 Att.

- Click ‘Get Form’ button to access the form and open it in an online editor.

- Begin by providing your name(s) as shown on your Form IT-203 and entering your social security number in the designated fields.

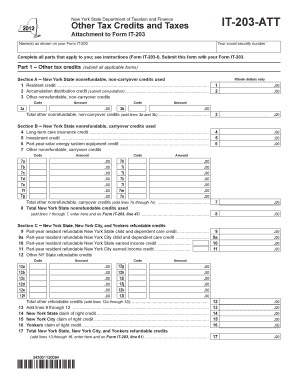

- In Part 1, address the Other tax credits. Complete Section A if you have any applicable nonrefundable, non-carryover credits by filling in the information related to the resident credit, accumulation distribution credit, and any other applicable credits.

- Proceed to Section B to detail any nonrefundable, carryover credits used. Be sure to list each credit and its corresponding amount accurately.

- Continue with Section C to report any refundable credits related to New York State, New York City, and Yonkers. Fill in credits such as the part-year resident refundable New York State child and dependent care credit and earned income credit.

- After completing all applicable sections, ensure to total the credits as indicated in the form, and enter these amounts on the corresponding lines for Form IT-203.

- In Part 2, outline any Other New York State taxes. List the capital gain tax on lump-sum distributions and any additional applicable state tax credits or amounts.

- Once all sections of the form are filled out, review your entries for accuracy before finalizing them.

- You can save your changes, download the completed form, print it for your records, or share it as needed.

Complete your documents online effortlessly by following these simple steps.

Determining how many allowances to claim on your Form 2104 can significantly impact your tax withholdings. Consider factors such as your filing status, dependents, and any additional income when calculating your allowances. Using the Form It 203 Att can help you evaluate your situation more accurately. If unsure, consulting a tax professional can provide personalized guidance to optimize your withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.