Loading

Get St 809

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 809 online

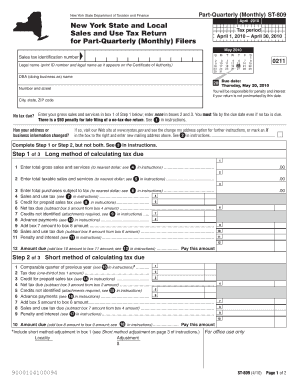

Filling out the St 809 form online is an essential step for businesses to report their sales and use tax in New York. This guide provides straightforward instructions to help users accurately complete the form and ensure compliance with tax regulations.

Follow the steps to complete the St 809 form online.

- Press the ‘Get Form’ button to access the St 809 form and open it in your preferred editor.

- Fill out the tax period by entering the relevant dates (e.g., April 1, 2010 – April 30, 2010) in the provided section.

- Enter your sales tax identification number in the designated field.

- Print your legal name as it appears on your Certificate of Authority in the corresponding box, along with your Doing Business As (DBA) name.

- Ensure you complete either Step 1 or Step 2 according to your calculation preference, but avoid completing both.

- In Step 1, enter the total gross sales and services to the nearest dollar in the appropriate box.

- Continue filling out Step 1 by entering total taxable sales and services, purchases subject to tax, and calculating net tax due as instructed in the form.

- If you choose Step 2, begin with the comparable quarter of the previous year and follow the subsequent steps to calculate tax due.

- Once all relevant fields are filled out, review the information to ensure accuracy.

- Save your changes and select the option to download, print, or share the completed form as needed.

Complete your St 809 and other documents online for a seamless filing experience.

You can easily obtain a W-9 form by visiting the IRS website. The form is available for download in PDF format, allowing you to fill it out at your convenience. After completing the form, you should submit it to the requester, typically a client or employer who needs your taxpayer information. This form is crucial for tax reporting purposes, including the important St 809 considerations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.