Get Ct250 Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct250 Tax Form online

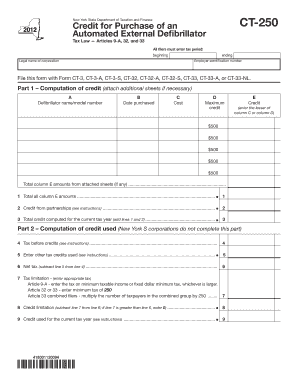

The Ct250 Tax Form is essential for claiming a tax credit for the purchase of an automated external defibrillator. This guide provides clear, step-by-step instructions to help users easily complete the form online.

Follow the steps to effectively complete the Ct250 Tax Form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax period by providing the beginning and ending dates. Make sure this information aligns with the relevant tax year.

- Proceed to Part 1 – Computation of credit. Here, you need to list each automated external defibrillator purchased during the tax year. For each item, enter the name/model number in column A, the purchase date in column B, and the cost of the defibrillator in column C.

- At the bottom of Part 1, total all amounts in column E. If you have attached additional sheets for more devices, ensure these totals are included here.

- Move to Part 2 – Computation of credit used, if applicable. This part does not apply to New York S corporations. Start by entering your tax before credits from the associated franchise tax return.

- Determine the tax limitation as per the instructions provided based on the relevant articles and enter the appropriate value.

- Finally, review your entries for accuracy. Save any changes made to the form. You can choose to download, print, or share the completed form as needed.

Start filling out your Ct250 Tax Form online today to ensure you can claim your tax credit efficiently.

To fill out tax forms effectively, gather your financial documents, including income statements, expense records, and any previous tax returns. For the Ct250 Tax Form, ensure you have your business identification number and details regarding your business structure. Having all necessary information organized will simplify the process and help you avoid mistakes. If you need assistance, uslegalforms offers resources to guide you through the completion of tax forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.