Loading

Get Ct 635 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 635 Form online

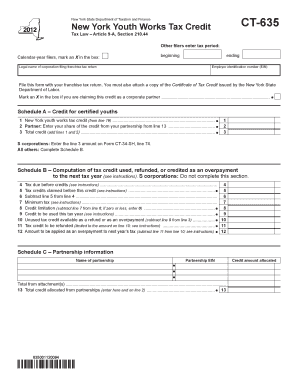

The Ct 635 Form is a crucial document for claiming the New York youth works tax credit. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online, ensuring all necessary information is included.

Follow the steps to fill out your Ct 635 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling in the section titled 'Tax period.' Indicate the tax period by marking the appropriate box for the calendar year, providing the beginning and ending dates as applicable.

- Enter the legal name of the corporation that is filing the franchise tax return in the designated field. Ensure that the name matches the official records.

- Input the employer identification number (EIN) in the corresponding field to accurately identify your corporation.

- Attach a copy of the Certificate of Tax Credit issued by the New York State Department of Labor. Note the requirement to file this form along with your franchise tax return.

- In Schedule A, report the New York youth works tax credit from line 19 in the appropriate field, along with the partner's share of the credit from line 13 if you are a corporate partner.

- Total the credits by adding the amounts from Schedule A and proceed to Schedule B if applicable. Ensure that any tax credits claimed previously are properly noted.

- Complete Schedule B, calculating the tax credits used, refunded, or credited as an overpayment for the next tax year, following the instructions for each line.

- Fill out Schedule C with the name and EIN of the partnership and include the total credit allocated from partnerships.

- In Schedule D, provide detailed information for each certified youth, including hire dates, social security numbers, and hours worked over the applicable months.

- Compute the total tax credit for each employee, summing the necessary amounts based on the instructions provided.

- Finalize your form by reviewing all sections for accuracy. You can then save your changes, download the completed form, print it, or share it as needed.

Complete your Ct 635 Form online today to claim your tax credit!

The 1095-C form is mandatory for certain employers who offer health coverage to their employees. This form helps employers report compliance with the Affordable Care Act. If you're unsure about whether you need it, consulting the Ct 635 Form and resources from UsLegalForms can clarify your responsibilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.