Loading

Get It203x Instructions 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It203x Instructions 2012 Form online

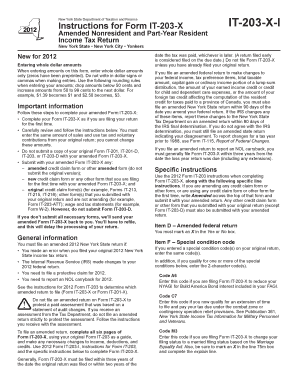

Filling out your It203x Instructions 2012 Form online can simplify the process of amending your nonresident and part-year resident income tax return. This guide will provide you with a clear framework to navigate each section of the form, ensuring compliance and accuracy.

Follow the steps to complete your online form accurately.

- Click ‘Get Form’ button to access the It203x Instructions 2012 Form and open it in the designated online editor.

- Complete your Form IT-203-X as if you are filing your return for the first time. Refer to the specific instructions provided for each section.

- In Item D, indicate whether you have an amended federal return by marking an X in the Yes or No box.

- For Item F, enter any special condition codes that apply to your amendments. Make sure to use the same codes as on your original return as needed.

- Fill in Line 16 for any other income, specifically noting if you are reporting an NOL carryback deduction. Provide the appropriate federal and New York State amounts.

- If you previously itemized deductions, enter the same figures on the New York State itemized deduction schedule on page 3, unless you are making changes.

- For refund details, complete Line 70 by selecting your preferred method for receiving your refund: direct deposit, debit card, or paper check.

- If you owe additional tax, complete Line 71, ensuring full payment is enclosed with your return when applicable.

- Before submitting, review all entries for accuracy, ensuring that all required documentation accompanies your amended form.

- Once all information is complete, save your changes, download a copy for your records, and print your form if needed to mail it.

Prepare your amended It203x Instructions 2012 Form online today for a smooth filing experience.

You can access IRS forms by visiting the official IRS website, where you can search for and download various forms. If you need a specific form, such as the It203x Instructions 2012 Form, uslegalforms can be a valuable resource for accessing and understanding the required documents. This platform streamlines the process for you, ensuring you find exactly what you need.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.