Loading

Get Dtf 32

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DTF 630 online

Filling out the DTF 630 form online can be a straightforward process if you follow step-by-step instructions. This guide provides clear information on how to complete the form effectively, ensuring that you understand each component and section involved in the filing process.

Follow the steps to complete the DTF 630 online form.

- Click ‘Get Form’ button to access the DTF 630 form and open it in the editor.

- Enter the tax period. This includes the start and end dates, which are critical for accurate reporting.

- Provide the name(s) exactly as they appear on your tax return.

- Input the taxpayer identification number, which is essential for identification purposes.

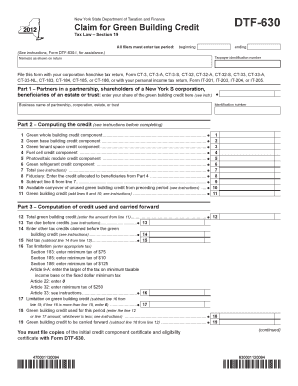

- In Part 1, enter the business name if applicable, along with the identification number designated for partnerships, corporations, estates, or trusts.

- Move to Part 2, where you will compute the credit. Fill out each line related to different green building credit components, ensuring accurate calculations before proceeding.

- In line 7, calculate the total credits available and ensure that you allocate the credit to beneficiaries, if required, in line 8.

- Continue through the computation of credit used and carried forward outlined in Part 3, ensuring that you follow the instructions provided for each line.

- Review all entries for accuracy and completeness before proceeding to the final steps.

- Once satisfied, you can save your changes, and if necessary, download, print, or share the form accordingly.

Complete your DTF 630 form online today for a seamless filing experience.

Yes, you must report any refund you receive from a 1099-G for state or local taxes. This amount may affect your overall tax liability for the year. Properly reporting this ensures compliance with tax laws and can prevent future issues. Use Dtf 32 to understand how to report this correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.