Loading

Get Schedule N Taxes On Selected Sales And Services In Nyc June 1 2012 To August 31 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule N Taxes On Selected Sales And Services In Nyc June 1 2012 To August 31 2012 Form online

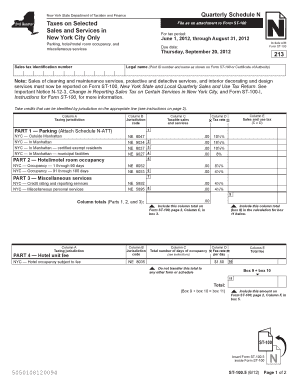

Filling out the Schedule N form accurately is crucial for reporting taxes on selected sales and services in New York City. This guide provides a clear, step-by-step approach to help users complete the form online with confidence.

Follow the steps to fill out the Schedule N form effectively.

- Press the ‘Get Form’ button to access and open the Schedule N form in your browser's PDF viewer.

- Enter your sales tax identification number in the designated field, ensuring it matches the information provided on Form ST-100 or your Certificate of Authority.

- Complete Part 1 by reporting your parking services. Enter the receipts for services provided in various NYC jurisdictions — outside Manhattan, in Manhattan, certified exempt residents in Manhattan, and municipal facilities.

- In Part 2, detail your hotel/motel occupancy. Report receipts for stays of 1 through 90 days and for stays of 91 through 180 days, ensuring accurate tax calculations.

- Move to Part 3 and fill in the data for miscellaneous services provided. This includes categories like credit rating and reporting services, and other personal services.

- Calculate the sales and use tax. For each line in Column C, multiply the taxable sales by the corresponding tax rate from Column D, and record the result in Column E.

- In Part 4, report hotel unit fees by stating the total number of days of occupancy, multiplying this by $1.50, and entering the result as the total fee.

- Add your totals from Parts 1, 2, and 3, and enter these values in the corresponding boxes on the form.

- Once all fields are complete, review your entries for accuracy and save your changes.

- Finally, download, print, or share the completed form as required for submission with Form ST-100 before the due date.

Start completing your Schedule N form online today for timely tax reporting.

Form IT-201 is the New York State Resident Income Tax Return, while Form IT-203 is for non-residents. If you're submitting a return for income earned in New York, you will likely use Form IT-201. Ensure you complete the Schedule N Taxes On Selected Sales And Services In Nyc June 1 2012 To August 31 2012 Form if applicable to your situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.