Get It 2658 E Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It 2658 E Instructions online

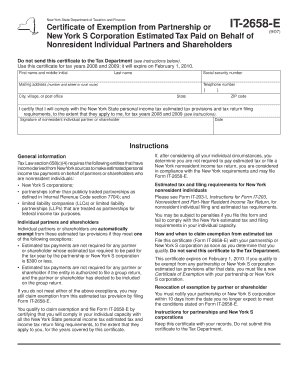

Filling out the It 2658 E form correctly is essential for nonresident individuals seeking exemption from estimated tax provisions in New York. This guide provides clear, step-by-step instructions to help you navigate the process efficiently.

Follow the steps to complete the It 2658 E Instructions online.

- Press the ‘Get Form’ button to obtain the document and open it in your preferred digital form editor.

- Begin by entering your first name and middle initial in the designated field.

- Next, fill in your last name accurately.

- Provide your social security number in the appropriate section to verify your identity.

- Enter your mailing address, ensuring you include your street number and name or rural route if applicable.

- Fill in your telephone number, including the area code, for any necessary communications.

- Indicate your city, village, or post office in the designated field.

- Specify the state you reside in.

- Lastly, enter your ZIP code to complete your address.

- Review the certification statement and ensure you agree to comply with the New York personal income tax requirements. Then, affix your signature in the provided space.

- Date the form to validate your certification.

- Once all fields are completed, save your changes, and choose to download, print, or share the form as necessary.

Complete your documents online today to ensure compliance with tax requirements.

Related links form

When filling out a tax exemption certificate, ensure you include your name, address, and the reason for your exemption. Follow the guidelines provided in the It 2658 E Instructions to ensure your form meets all legal requirements. It’s important to provide accurate and truthful information, as errors can lead to complications. Utilizing uslegalforms can streamline this process, offering templates and expert advice to help you complete your exemption certificate correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.