Get It2658 2013 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

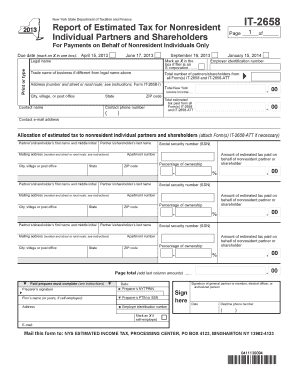

How to fill out the IT-2658 2013 Form online

Filling out the IT-2658 2013 Form online can be straightforward with the right guidance. This guide is designed to assist users in navigating each section of the form, ensuring all necessary information is accurately provided.

Follow the steps to complete the IT-2658 online

- Press the ‘Get Form’ button to retrieve the IT-2658 form and open it for editing.

- Begin by indicating the due date for the payment. Mark an 'X' in the appropriate box for either April 15, June 17, or September 16.

- Input the legal name of the entity required to file the form. If the trade name differs from the legal name, enter it as well.

- Provide the total number of partners or shareholders associated with this filing, summing the amounts from all IT-2658 and IT-2658-ATT forms.

- Fill out the address section with the complete address, including number and street, city or town, state, and ZIP code.

- Enter the contact name, phone number, e-mail address, and employer identification number (EIN) for the respective entity.

- Report the total New York source income, ensuring accurate figures to represent your financials.

- Allocate estimated tax amounts to nonresident individual partners and shareholders. For each individual, fill in their first name, last name, mailing address, social security number (SSN), calculated amounts of estimated tax paid, ownership percentage, and any additional required fields.

- If more space is needed for additional partners or shareholders, attach Form(s) IT-2658-ATT as necessary.

- Once all sections have been completed accurately, proceed to save changes. Additionally, you can download, print, or share the form for your records or submission.

Complete your IT-2658 2013 Form online today!

To claim the DTAA benefit in your Income Tax Return (ITR), you must provide relevant documentation that establishes your eligibility. This includes showing proof of tax payments in the other country and completing the necessary sections of your tax return. The process can be complex, but understanding the requirements for the IT 2658 2013 Form can streamline your filing. For further assistance, the uslegalforms platform can guide you through the claiming process effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.