Loading

Get Td346

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Td346 online

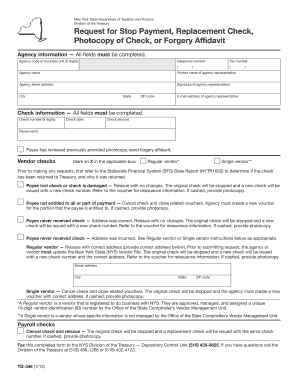

The Td346 form, issued by the New York State Department of Taxation and Finance, is essential for requesting stop payment, replacement checks, photocopies of checks, or forgery affidavits. This guide provides step-by-step instructions to help users fill out the form accurately and efficiently.

Follow the steps to complete the Td346 form online.

- Click the ‘Get Form’ button to access the Td346 form and open it in an online editing tool.

- In the agency information section, enter the agency code or business unit (5 digits), agency name, telephone number, and fax number. Ensure all fields are filled out accurately.

- Provide the printed name and signature of the agency representative, along with their email address, street address, city, state, and ZIP code.

- In the check information section, fill in the check number (8 digits), check date, check amount, and payee name. If the payee requires a forgery affidavit, indicate that as well.

- Choose the appropriate check type by marking an X in the applicable box: Regular vendor or Single vendor. Refer to the Statewide Financial System (SFS) Stale Report (NYTR1652) if necessary.

- If the payee has lost the check or if the check is damaged, select the corresponding option to reissue with no changes. Remember to provide a photocopy if the check has been cashed.

- If the check needs to be reissued due to an incorrect address, ensure the new address details are entered correctly, and update the New York State Vendor File as needed.

- For payroll checks, select the option to cancel the check and reissue it. Confirm that the original check will be stopped and the replacement issued using the same check number.

- Once all sections are completed, review the form carefully for accuracy. Save any changes made, and prepare to submit the form.

- Fax the completed form to the NYS Division of the Treasury — Depository Control Unit at (518) 435-8625. For inquiries, contact the Division of the Treasury at (518) 486-1268 or (518) 402-4123.

Complete your Td346 form online today for a seamless submission experience.

Send your NYS estimated tax payments to the address listed for estimated payments in the New York State tax guidelines. Properly mailing these payments ensures you avoid penalties and interest on late payments. If you find the process confusing, consider utilizing the Td346 feature on UsLegalForms to help you navigate your tax responsibilities with ease.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.