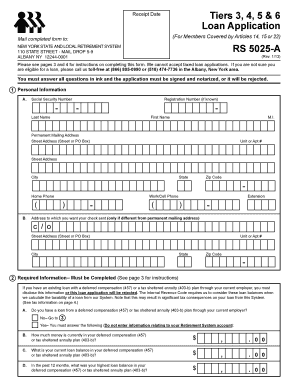

Get Tiers 3, 4, 5 & 6 Loan Application For Members Covered By Articles 14, 15 Or 22

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tiers 3, 4, 5 & 6 Loan Application For Members Covered By Articles 14, 15 Or 22 online

Filling out the Tiers 3, 4, 5 & 6 Loan Application is an essential process for members seeking financial assistance through the Retirement System. This guide provides a clear, step-by-step approach to completing the application online, ensuring that all necessary information is accurately provided.

Follow the steps to fill out your application correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out your personal information. This includes your social security number, last name, first name, middle initial, and permanent mailing address. Make sure to double-check your information for accuracy.

- Complete the required information section. If you have an existing loan with a deferred compensation (457) or tax sheltered annuity (403-b) plan through your current employer, indicate 'Yes' and provide your current loan balance and highest loan balance in the past 12 months.

- Select your loan type. Only one option can be chosen: Loan Type 1 if you have no existing loan, Loan Type 2 for a multiple loan, or Loan Type 3 for a refinanced loan. Make sure to read the descriptions carefully to select the appropriate type.

- Determine the loan amount you are applying for. Choose between a maximum non-taxable loan, a specific loan amount, or a maximum loan amount, and specify your repayment preferences.

- Fill out the payroll information section accurately. This includes your employer's name, annual salary, and payroll frequency. Make sure to indicate your employment term as well.

- Sign the application in ink. Ensure that the signature matches the name provided in the personal information section.

- Complete the notary public acknowledgement section. This must be done for your application to be accepted. Reach out to a notary to finalize this step.

- Review the entire application for any missing fields or errors. Once confirmed, you can save changes, download, print, or share the completed application.

Complete your application online today to ensure a smooth processing experience.

After you submit your loan application, you should receive a Loan Estimate within three business days, detailing the terms of the loan, projected payments, and closing costs. This document is crucial for the Tiers 3, 4, 5 & 6 Loan Application For Members Covered By Articles 14, 15 Or 22, as it provides transparency and helps you make informed decisions. Additionally, you may receive a confirmation of your application submission. This ensures you are always informed about the status of your loan application.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.