Get Pw 12

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pw 12 online

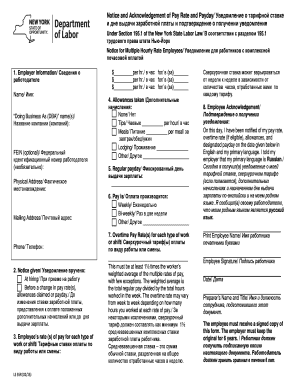

The Pw 12 form is a crucial document for employers in New York State, providing essential information regarding pay rates and paydays. This guide will walk you through the process of filling out this form online, ensuring compliance with labor laws while supporting transparency in employment practices.

Follow the steps to complete the Pw 12 form online effectively.

- Press the ‘Get Form’ button to access the Pw 12 form and open it in your document editor.

- Fill in the employer information section, including the full name of the employer and any 'Doing Business As (DBA)' names. Optionally, provide the Federal Employer Identification Number (FEIN) and include the physical and mailing addresses, along with a contact phone number.

- Indicate when the notice is given. You can choose from options such as 'At hiring' or 'Before a change in pay rate(s) or payday'. Make sure to select the appropriate circumstance for your situation.

- List the employee’s rate(s) of pay for each type of work or shift, entering the amount per hour for each respective job or shift.

- If applicable, specify any allowances taken by selecting relevant options, such as tips or meals, and providing details for each if necessary.

- Clearly state the regular payday schedule by entering the specific day of the week or month.

- Outline how often pay is distributed by selecting an option like 'Weekly' or 'Bi-weekly'.

- Detail the overtime pay rate(s) for each type of work or shift, ensuring that the rates comply with the legal requirement to be at least 1½ times the worker’s weighted average of the multiple pay rates.

- Complete the employee acknowledgment section by having the employee print their name, sign, and date the form. Also, include the preparer’s name and title.

- Ensure that the employee receives a signed copy of the form, and the employer retains the original for six years.

Complete your documents online to ensure compliance and support transparent employment practices.

For box 12 on your tax return, you will enter the amounts shown in box 12 of your W-2 along with their corresponding codes. Each code represents a different type of income or deduction, so be sure to follow the IRS guidelines closely. Accurate reporting is crucial to avoid any complications. Uslegalforms can provide valuable resources to ensure you complete this step correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.