Get Ia198p

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ia198p online

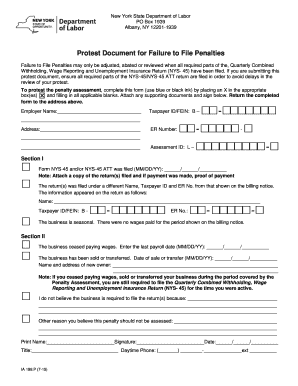

This guide provides a clear and comprehensive overview of how to effectively fill out the Ia198p form online. By following these instructions, users can ensure that their document is completed accurately and thoroughly.

Follow the steps to complete your Ia198p form with ease.

- Press the ‘Get Form’ button to retrieve the Ia198p document and open it within the designated editor.

- Input the employer name in the designated field, ensuring that all details are correct.

- Enter your Taxpayer ID/FEIN in the corresponding blank, using the specified format.

- Complete the address field with the current address of your business.

- Fill in the Employer Registration (ER) Number as prompted, ensuring that you follow the correct format.

- In Section I, indicate whether the NYS-45 and/or NYS-45 ATT was filed by entering the date in MM/DD/YY format.

- If applicable, provide information regarding a different name, Taxpayer ID, or ER Number that appeared on the return.

- State the reason if the business is seasonal and no wages were paid for the specified period.

- In Section II, specify whether the business has ceased paying wages, sold or transferred. Record the relevant dates as needed.

- If applicable, enter the name and address of the new owner if the business has been sold or transferred.

- Provide a brief explanation of why you believe the business is not required to file returns.

- Print your name, sign the document, and indicate the date of signing.

- Provide your title and daytime phone number with extension if applicable.

- Once the form is completed, save your changes and ensure that all supporting documents are attached before submitting.

Complete your Ia198p form online today to ensure your protest is processed efficiently.

Related links form

To fill out the NY state withholding form, start by determining the appropriate form based on your employment status and income level. Gather your personal information, including your Social Security number and details of your allowances. Using the UsLegalForms platform can simplify this process, providing you with the right templates and guidance. This ensures that your Ia198p form is filled out accurately, helping you manage your tax withholdings effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.