Loading

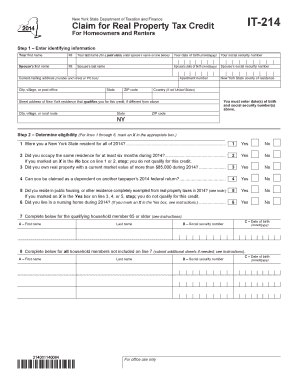

Get Tax Forms 214 And 210

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Forms 214 and 210 online

Filling out tax forms can seem daunting, but with this comprehensive guide, you'll learn to complete Tax Forms 214 and 210 online with ease. This guide will walk you through each step, ensuring a smooth and efficient process.

Follow the steps to fill out your Tax Forms 214 and 210 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your identifying information including your first and last name, date of birth, social security number, and current mailing address. For joint claims, include your partner's information.

- Mark your eligibility by answering the questions regarding your residency, property ownership, and income status. If you do not qualify based on your answers, you may need to stop completing the form.

- Calculate your household gross income by adding all relevant sources of income. Ensure this total does not exceed $18,000 to qualify for the credit.

- For renters, enter the total rent paid during the year, while homeowners should input their real property taxes paid during the year. Follow specific instructions regarding the adjustments.

- Compute the credit amount based on your entries. Be mindful of any maximum limits specified in the instructions.

- Enter your account information if you wish to receive a refund via direct deposit. Ensure all required fields are filled accurately.

- Finalize your form by signing and dating it. If filing jointly, your partner should also sign the form.

- Save changes to your completed form and choose to download, print, or share it as needed.

Complete your documents online today to ensure timely processing of your tax credits.

You should mail NY IT201 to the address specified in the instructions on the form. This address may vary depending on whether you are including a payment or not. For added convenience, you can also check the US Legal Forms platform for updated mailing information related to Tax Forms 214 and 210.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.