Get Universal Intake Form - State Of Oregon - Doj State Or

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Universal Intake Form - State Of Oregon - Doj State Or online

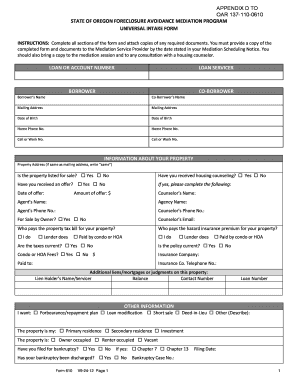

The Universal Intake Form for the State of Oregon is a crucial document in the foreclosure avoidance mediation program. This guide will provide you with clear, step-by-step instructions on how to complete the form accurately and efficiently to facilitate your mediation process.

Follow the steps to successfully complete the Universal Intake Form online.

- Press the ‘Get Form’ button to access the Universal Intake Form and open it in your preferred document editor.

- Begin with the ‘Loan or Account Number’ section, where you will input the relevant identification number for the loan.

- In the ‘Loan Servicer’ field, enter the name of the organization managing your loan.

- Fill in the ‘Borrower’ and ‘Co-Borrower’ sections with the full names of the individuals applying.

- Provide the ‘Mailing Address’ for both the borrower and co-borrower in the respective fields.

- Complete the ‘Date of Birth’ fields for both the borrower and co-borrower.

- Input contact numbers in the specified sections for home, cell or work phone numbers.

- For ‘Information About Your Property,’ state the property's address. If it matches the mailing address, simply write 'same'.

- Indicate whether the property is listed for sale by selecting ‘Yes’ or ‘No’.

- Confirm if you have received housing counseling by selecting ‘Yes’ or ‘No’ and complete the following fields if applicable.

- If you have received an offer, provide details such as the date of the offer, the name and phone number of the counselor, and the amount of the offer.

- Identify who pays the property tax and hazard insurance premiums from the available options.

- In the ‘Other Information’ section, mark your request from the provided options like ‘Forbearance’ or ‘Loan modification’.

- Detail your residency status regarding the property, clarifying if it's a primary residence or an investment.

- If you have filed for bankruptcy, detail the chapter and indicate if it has been discharged.

- In the ‘Income and Assets’ section, list all sources of income and assets, ensuring you total the amounts accurately.

- Move to the ‘Expenses and Debts’ section, entering all relevant monthly and annual expenses.

- Complete the ‘Hardship Affidavit’ by checking all applicable reasons for your financial difficulties.

- Collect and attach the required verification documents as outlined on the form.

- Lastly, review all entries for accuracy, sign the form, and ensure you provide a copy to the Mediation Service Provider by the specified date.

Complete your Universal Intake Form online today to initiate your mediation process.

To determine the hourly rate for an annual salary of $70,000 in Oregon, you can divide the total salary by the number of work hours in a year. Assuming a standard full-time schedule, this translates to approximately $33.65 per hour. Understanding this conversion can help individuals budget their finances effectively, especially when considering expenses related to legal services, such as those provided by the Universal Intake Form - State Of Oregon - Doj State Or.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.