Get Pf 10pf 20 Oregon Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pf 10pf 20 Oregon Form online

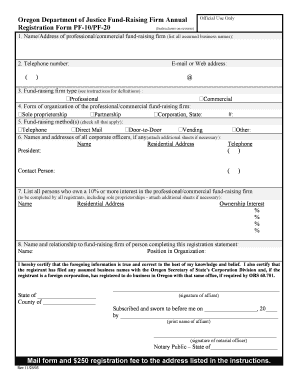

Filling out the Pf 10pf 20 Oregon Form online can streamline your registration process as a professional or commercial fund-raising firm. This guide provides clear and detailed instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the Pf 10pf 20 Oregon Form online

- Press the ‘Get Form’ button to access the Pf 10pf 20 Oregon Form and open it in your preferred editor.

- In section 1, enter the full name and principal address of your fund-raising firm, including any assumed business names.

- For section 2, provide the telephone number of your firm and, if applicable, include the e-mail address or website.

- In section 3, select the type of fund-raising firm by checking the appropriate box for professional or commercial.

- Proceed to section 4 and specify the form of organization of your firm, such as sole proprietorship, partnership, or corporation. If applicable, include your business registry number.

- For section 5, indicate the methods your firm employs for fund-raising by checking all applicable options.

- In section 6, if your firm is a corporation, list the names and addresses of all corporate officers, including their contact numbers.

- For section 7, provide the names and residential addresses of individuals who own 10% or more interest in your firm, including their percentage of ownership.

- In section 8, fill in the name and position of the individual completing the form.

- Ensure that the signature section is completed by an authorized officer, and remember that this signature must be notarized.

- Review all entries for accuracy, then save your changes. You can download or print the completed form for submission.

Begin the registration process by completing your Pf 10pf 20 Oregon Form online today.

The CT 12 form in Oregon is a tax form used for corporate tax reporting purposes. It is essential for corporations to file this form to report their income, deductions, and credits accurately. Understanding the Pf 10pf 20 Oregon Form can help clarify how it relates to your overall tax obligations. If you need assistance with this process, uslegalforms offers resources to help you navigate Oregon's tax forms and requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.