Get Closing Form - Oregon Department Of Justice - Doj State Or

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Closing Form - Oregon Department Of Justice - Doj State Or online

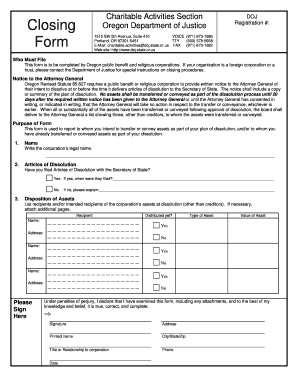

Filling out the Closing Form from the Oregon Department of Justice is an essential step for public benefit and religious corporations intending to dissolve. This guide provides clear, step-by-step instructions to assist you in completing the form accurately while navigating the online filing process with ease.

Follow the steps to complete the Closing Form correctly.

- Press the ‘Get Form’ button to obtain the Closing Form and open it for editing.

- Begin filling out the form by entering the corporation’s legal name in the designated section.

- Indicate whether you have filed Articles of Dissolution with the Secretary of State by selecting 'Yes' or 'No.' If 'Yes,' provide the filing date in the space provided.

- If you answered 'No' to the previous question, provide an explanation for not filing the Articles of Dissolution.

- List the recipients of the corporation’s assets at dissolution, excluding creditors. Enter each recipient's name and address. If you need more space, feel free to attach additional pages.

- In the 'Type of Asset' section, specify the types of assets being transferred, along with their estimated value.

- Sign and date the form to attest to its accuracy and completeness. Ensure to provide your printed name, title or relationship to the corporation, and a contact phone number.

- Once all fields are filled out and checked for accuracy, save your changes. You can then download, print, or share the form as needed.

Complete your documents online to ensure smooth processing and compliance with dissolution requirements.

Dissolving a nonprofit in Oregon requires a structured approach. First, you must hold a meeting to approve the dissolution and document this decision. Next, you'll need to file the Closing Form - Oregon Department Of Justice - Doj State Or, ensuring all legal obligations are met. Finally, make sure to settle all debts and notify the IRS. To streamline these steps, uslegalforms can provide the necessary forms and instructions to guide you through the dissolution process effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.