Loading

Get Oregon Form Form 440 3431

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Oregon Form Form 440 3431 online

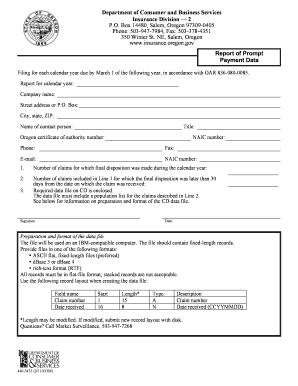

Filling out the Oregon Form 440 3431 online can seem daunting, but it is a straightforward process. This guide will provide you with step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Oregon Form 440 3431 online.

- Use the ‘Get Form’ button to access the Oregon Form 440 3431, and open it in your preferred editor.

- Begin by entering the report year for which you are filing in the designated field. This should reflect the calendar year for your data.

- Input your company's name in the relevant field, ensuring that it matches your registered name.

- Fill in your street address or P.O. Box. Make sure this is the official address of your company.

- Enter the city, state, and ZIP code associated with your company’s address.

- Provide the name of a contact person within your organization who can address questions regarding this form.

- Indicate the title of the contact person in the appropriate section.

- Include your Oregon certificate of authority number. This is critical for identification in the registration system.

- Fill in your NAIC number, which is essential for tracking and regulatory purposes.

- Provide the contact person's phone number and fax number.

- Include the contact person's email address to facilitate communication.

- Answer the two questions about claim dispositions: the total number of claims and those finalized beyond 30 days.

- Ensure that the required data file on CD is prepared and enclosed as per the specified format guidelines.

- Sign the form and date it to validate your submission.

- Once all fields are completed, save your changes. You can then download, print, or share the form as necessary.

Get started with completing your Oregon Form 440 3431 online today!

Form 40N is the official non-resident tax return for Oregon. It is designed for individuals who earn income in Oregon but do not reside in the state. By utilizing Oregon Form Form 440 3431, you can better understand the filing process and ensure you are fulfilling your tax obligations correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.