Loading

Get Sd Eform 1288 Help V2 Application For Continuing Tax Exempt Status Of A Private Organization (sdcl

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SD EForm 1288 HELP V2 application for continuing tax-exempt status of a private organization (SDCL online

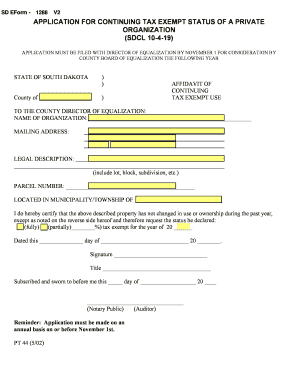

This guide provides clear and supportive instructions for users on how to effectively complete the SD EForm 1288 HELP V2 application for continuing tax-exempt status. The application allows private organizations to maintain their tax-exempt status with the county board of equalization.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to access the form and open it in the designated editing interface.

- Enter the name of the organization in the designated field. Be sure to provide the full legal name as listed on official documents.

- Fill in the mailing address for the organization accurately to ensure any correspondence is directed correctly.

- Provide the legal description of the property. Include details such as lot, block, and subdivision to ensure accurate identification.

- Input the parcel number for the property in the specified field. This number is critical for tax assessment.

- Indicate the municipality or township where the property is located. This information assists the county in processing the application.

- Certify that the property has not changed in use or ownership during the past year by selecting the appropriate option regarding tax-exempt status for the upcoming year.

- Complete the dating section by entering the current date in the provided format.

- Sign the application in the signature field. Include the title of the person signing the form to validate the submission.

- After completing the form, utilize the options to print for mailing or to save changes. Ensure to maintain a copy of the application for your records.

Complete your application online today to ensure timely submission before the November 1 deadline.

Yes, South Dakota sales tax exemption certificates can expire. Organizations should keep track of their certificate status and renew them as required to maintain their tax-exempt status. Utilizing the SD EForm 1288 HELP V2 APPLICATION FOR CONTINUING TAX EXEMPT STATUS OF A PRIVATE ORGANIZATION (SDCL) can help organizations stay compliant and up-to-date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.