Loading

Get Form 735 1334

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 735 1334 online

Filling out the Form 735 1334 online is a straightforward process that ensures compliance with Oregon's fuel tax regulations. This guide provides clear, step-by-step instructions to help users accurately complete the form with confidence.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

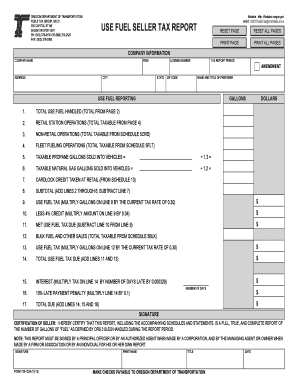

- Begin by entering the company information. Fill in the company name, FEIN (Federal Employer Identification Number), and address, including city, state, and zip code. Ensure that the information is accurate to facilitate processing.

- Indicate the tax report period for which you are filing. This is typically a calendar month, and you must ensure it aligns with reporting guidelines.

- If applicable, indicate if this form is an amendment by checking the amendment box.

- Provide the name and title of the person preparing the report. This information is essential for accountability.

- Enter the gallons and dollar amounts for each category outlined in the form. This includes total use fuel handled, retail station operations, non-retail operations, fleet fueling operations, and taxable sales for propane and natural gas. Use the provided calculations consistently.

- Calculate the use fuel tax based on the gallons and applicable tax rates. Ensure that formulas and calculations for credits and penalties are accurate.

- Review all entries for completeness and accuracy before finalizing the form to avoid errors that could result in penalties.

- Once finished, you can save changes, download the completed form, print it for your records, or share it if needed.

Begin filling out your Form 735 1334 online today to ensure compliance and ease of processing.

Related links form

The fuel tax in Oregon varies based on the type of fuel, including gasoline, diesel, and alternative fuels. Generally, the state imposes a tax per gallon, which contributes to road maintenance and infrastructure projects. Utilizing Form 735 1334 allows you to accurately report your fuel consumption and calculate the tax owed. Staying informed about these rates helps you budget for your transportation costs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.