Loading

Get Oregon Pers Iap Rollover

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oregon Pers Iap Rollover online

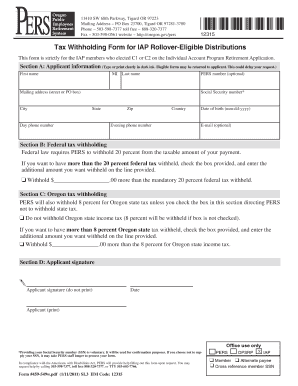

The Oregon Pers Iap Rollover form is essential for members wishing to rollover their Individual Account Program benefits. This guide provides clear and supportive instructions for accurately completing the form online, ensuring a smooth submission process.

Follow the steps to accurately fill out the form online:

- Press the ‘Get Form’ button to access the Oregon Pers Iap Rollover form and open it in your preferred editor.

- In Section A, enter your applicant information. Clearly type or print your first name, middle initial, and last name. Although the PERS number is optional, including it may help with processing.

- Provide your mailing address, including street or PO Box, city, state, zip code, and country. Ensure all information is legible to avoid delays.

- Fill in your day and evening phone numbers and, if available, your email address.

- Enter your date of birth in the format mm-dd-yyyy to verify your identity.

- In Section B, specify your federal tax withholding preferences. By default, the law requires a 20 percent withholding. If you wish to withhold more, check the provided box and indicate the additional amount.

- In Section C, indicate your Oregon state tax withholding. The default is 8 percent unless specified otherwise. To opt-out of withholding, check the box. If you want to withhold more than 8 percent, check the box and write in the additional amount.

- Proceed to Section D to sign and date the form. Ensure that you sign in the designated area and print your name.

- After completing all sections, save your changes. You can then download, print, or share your completed form as needed.

Begin your online process now to complete your Oregon Pers Iap Rollover form.

Yes, the Individual Account Program (IAP) is separate from the Public Employees Retirement System (PERS) in Oregon. While both are part of the retirement benefits offered to public employees, IAP focuses on individual contributions and investment growth. Understanding this distinction is crucial for effective planning regarding your Oregon PERS IAP rollover options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.