Loading

Get Pay Corptax Oregon Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pay Corptax Oregon Form online

Filling out the Pay Corptax Oregon Form is an essential step for businesses seeking to comply with state tax regulations. This guide provides clear and concise instructions to help users effectively complete the form online.

Follow the steps to successfully fill out the form.

- Press the ‘Get Form’ button to access the form, and open it in the designated editor.

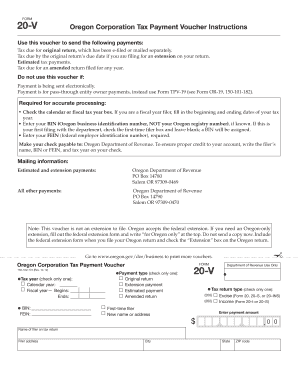

- Select the appropriate tax year by checking the calendar year or fiscal year box. If you are a fiscal year filer, be sure to enter the beginning and ending dates of your tax year.

- Input your Oregon business identification number (BIN) in the designated field. If you are filing for the first time and do not have a BIN, check the 'first-time filer' box and leave this field blank; a BIN will be assigned to you.

- Enter your federal employer identification number (FEIN) in the required field. Make sure this information is accurate as it is essential for processing your payment.

- Choose the payment type by checking only one option: original return, extension payment, estimated payment, or amended return.

- If applicable, fill in the name of the filer on the tax return, along with the corresponding address, city, state, and ZIP code.

- Specify the payment amount by entering the correct dollar figure in the provided space.

- To complete the process, save your changes. You will then have the option to download, print, or share the finalized document.

Complete your Pay Corptax Oregon Form online today to ensure compliance with state tax regulations.

Oregon does not have a traditional corporate income tax; instead, it imposes a corporate activity tax on businesses with substantial gross receipts. This tax structure requires businesses to file and pay using the Pay Corptax Oregon Form. Understanding these tax obligations is crucial for compliance and financial planning.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.